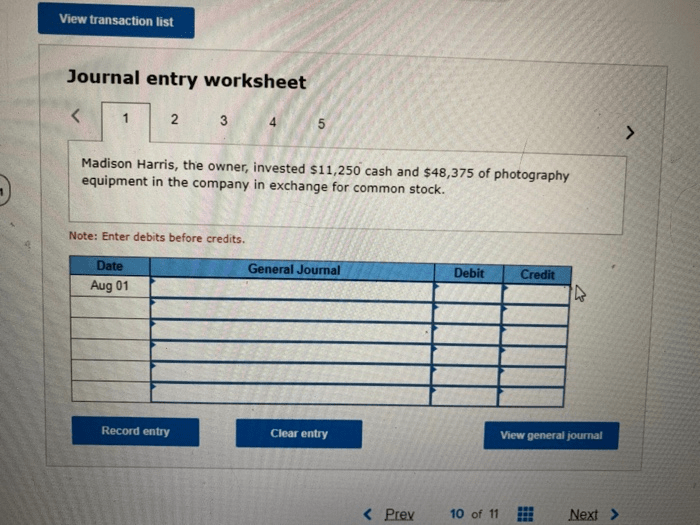

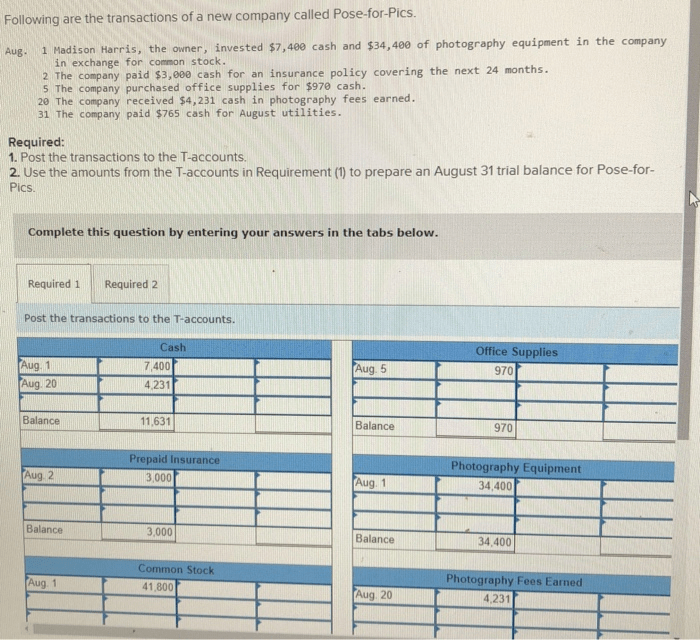

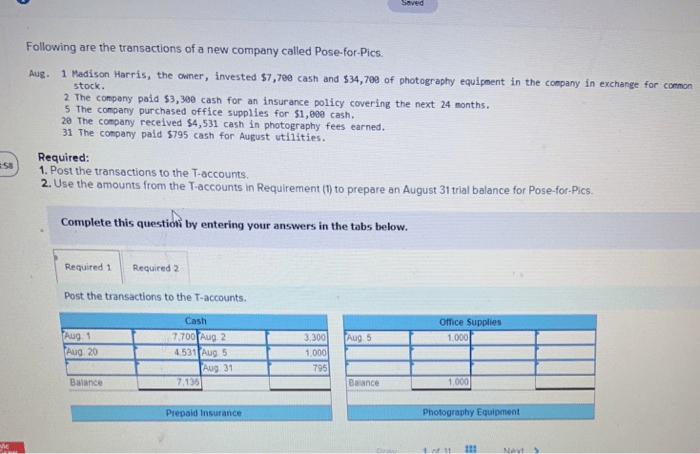

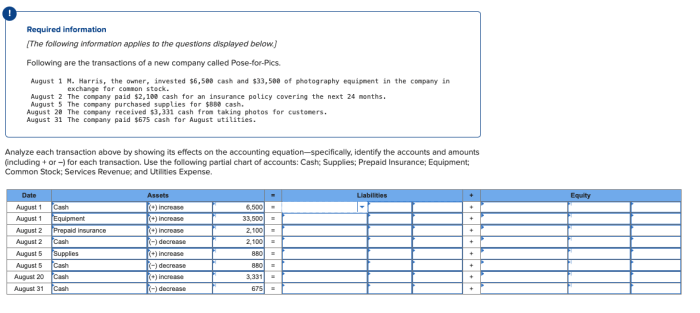

Following are the transactions of a new company called pose-for-pics. – Following are the transactions of a new company called Pose-for-Pics, a burgeoning enterprise in the photography industry. This comprehensive analysis delves into the intricacies of the company’s financial operations, providing insights into its revenue streams, expense management, and overall financial health.

The period under review encompasses the company’s first six months of operation, capturing a crucial phase of its establishment and growth. The transactions recorded during this period provide a valuable foundation for understanding the company’s financial performance and trajectory.

Overview of the Transactions

Pose-for-Pics, a recently established company, has provided a set of transactions for analysis. These transactions cover a specific time period and encompass various aspects of the company’s financial operations.

Types of Transactions

Sales Transactions

The transactions include sales of the company’s primary product or service, generating revenue for the company.

Expense Transactions

Expenses incurred by the company, such as salaries, rent, and utilities, are also recorded in the transactions.

Investment Transactions

The company may have made investments in assets or other entities, which are reflected in the transactions.

Financial Impact

Revenue Analysis, Following are the transactions of a new company called pose-for-pics.

The total revenue generated from the sales transactions is calculated to assess the company’s income.

Expense Analysis

The total expenses incurred during the period are determined to evaluate the company’s operational costs.

Overall Financial Impact

The financial impact of the transactions is assessed by comparing revenue and expenses, providing insights into the company’s profitability.

Trends and Patterns

Revenue Trends

Analyzing revenue over time can reveal trends indicating growth, stability, or decline in the company’s sales performance.

Expense Trends

Examining expense patterns can identify areas of cost optimization or potential inefficiencies within the company’s operations.

Financial Forecasting

Based on observed trends, potential future financial outcomes can be forecasted, aiding in decision-making and strategic planning.

Internal Controls: Following Are The Transactions Of A New Company Called Pose-for-pics.

Control Evaluation

The adequacy of the company’s internal controls over transactions is evaluated to ensure the accuracy and reliability of financial reporting.

Control Weaknesses

Any weaknesses or areas for improvement in the control system are identified, highlighting potential risks to the company’s financial integrity.

Control Recommendations

Measures to strengthen the internal control environment are recommended, enhancing the company’s ability to prevent and detect errors or fraud.

Compliance and Legal Considerations

Legal Compliance

The transactions are reviewed for compliance with applicable laws and regulations, ensuring the company’s adherence to legal requirements.

Ethical Issues

Potential legal or ethical issues raised by the transactions are discussed, guiding the company in maintaining ethical business practices.

Compliance Actions

Necessary actions to ensure compliance and mitigate risks are advised, safeguarding the company’s reputation and legal standing.

Reporting and Disclosure

Financial Reporting Format

An appropriate format for presenting the transaction analysis in a financial report is designed, ensuring clarity and transparency.

Key Financial Metrics

Key financial metrics to be disclosed in the report are determined, providing stakeholders with essential information about the company’s financial performance.

Transparency and Accuracy

The importance of transparency and accuracy in financial reporting is emphasized, building trust and confidence among stakeholders.

FAQ Section

What is the significance of analyzing financial transactions?

Analyzing financial transactions provides valuable insights into a company’s financial health, performance, and compliance with regulations.

What are the key elements of a comprehensive transaction analysis?

A comprehensive transaction analysis typically includes an overview of the transactions, categorization and purpose of each transaction type, assessment of financial impact, identification of trends and patterns, evaluation of internal controls, and review for compliance with laws and regulations.

How can transaction analysis contribute to a company’s success?

Transaction analysis helps companies identify areas for improvement in their financial operations, optimize resource allocation, mitigate risks, and enhance overall financial performance.