Macroeconomics Activity 4-3 Answer Key unveils the intricacies of macroeconomic variables, economic indicators, and policy frameworks that shape economic activity. Delving into this comprehensive guide, readers will embark on a journey to understand how macroeconomic forces influence business decisions, drive economic growth, and impact international economic linkages.

The following paragraphs delve into the key concepts of macroeconomics, providing a roadmap for understanding the complex interplay of variables that determine economic outcomes. From fiscal and monetary policies to the nuances of economic forecasting, this guide unravels the mysteries of macroeconomic activity, empowering readers to make informed decisions and navigate the dynamic economic landscape.

Macroeconomic Variables and Their Impact

Macroeconomic variables are broad measures that reflect the overall performance of an economy. Key macroeconomic variables include GDP, unemployment rate, inflation rate, and interest rates. Changes in these variables can significantly influence business decisions and economic growth.

For example, a rise in GDP indicates economic growth, which can lead to increased investment and job creation. Conversely, a high unemployment rate can discourage investment and slow down economic growth. Inflation rate affects consumer spending and business investment, while interest rates influence borrowing costs and investment decisions.

Government Policies and Macroeconomic Variables

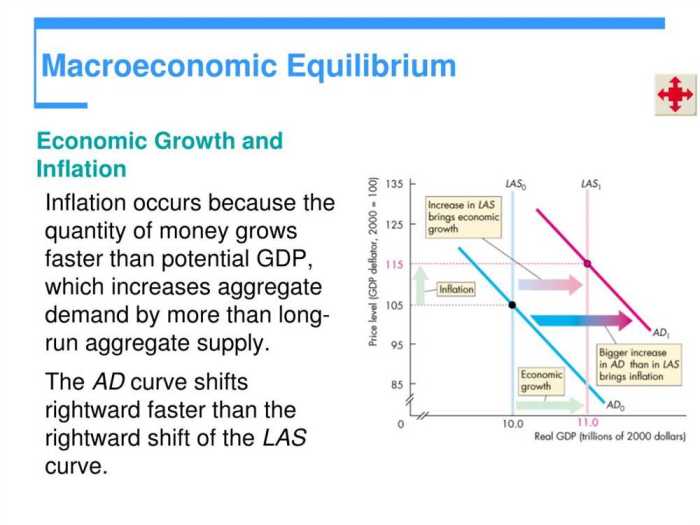

Governments use fiscal and monetary policies to manage macroeconomic variables. Fiscal policy involves government spending and taxation, while monetary policy is conducted by central banks through interest rates and money supply.

By adjusting these policies, governments can influence economic activity, such as stimulating growth during a recession or controlling inflation during an economic boom.

Economic Indicators and Forecasting

Economic indicators are data that provide insights into the current and future state of an economy. Key economic indicators include GDP growth rate, consumer confidence index, and leading economic indicators.

These indicators are used by economists, policymakers, and businesses to forecast economic trends. By analyzing historical data and current trends, economists can make predictions about future economic performance.

Challenges and Limitations of Economic Forecasting

While economic forecasting is an important tool, it also has its challenges and limitations. Economic data can be volatile and subject to revisions, making it difficult to make accurate predictions.

Additionally, unforeseen events, such as natural disasters or political instability, can disrupt economic forecasts.

Business Cycle and Economic Growth

The business cycle refers to the cyclical fluctuations in economic activity, characterized by periods of expansion and contraction. The different phases of the business cycle include expansion, peak, contraction, and trough.

Economic growth is the long-term increase in the productive capacity of an economy. Factors contributing to economic growth include technological advancements, capital investment, and human capital.

Macroeconomic Policies and Economic Growth, Macroeconomics activity 4-3 answer key

Macroeconomic policies play a crucial role in fostering economic growth. Governments can use fiscal and monetary policies to stimulate investment, create jobs, and maintain price stability.

By managing macroeconomic variables effectively, policymakers can create an environment conducive to long-term economic growth.

Fiscal and Monetary Policy

Fiscal policy involves government spending and taxation. Expansionary fiscal policy involves increasing government spending or reducing taxes to stimulate economic growth during a recession.

Monetary policy is conducted by central banks through interest rates and money supply. Expansionary monetary policy involves lowering interest rates or increasing money supply to encourage borrowing and investment.

Coordination of Fiscal and Monetary Policy

Fiscal and monetary policies should be coordinated to achieve macroeconomic stability. Excessive fiscal spending can lead to inflation, while overly tight monetary policy can stifle economic growth.

By working together, governments and central banks can ensure that macroeconomic variables are managed effectively, promoting economic growth and stability.

International Macroeconomic Linkages: Macroeconomics Activity 4-3 Answer Key

Macroeconomic developments in one country can have significant effects on other countries. Channels of international macroeconomic linkages include trade, exchange rates, and capital flows.

For example, a recession in one country can reduce demand for exports from other countries, leading to a decline in economic activity.

Globalization and Macroeconomic Stability

Globalization has increased the interconnectedness of economies, creating both opportunities and challenges for macroeconomic stability.

While globalization can facilitate economic growth through increased trade and investment, it can also expose countries to external shocks and financial instability.

General Inquiries

What are the key macroeconomic variables that affect economic activity?

Macroeconomic variables include GDP, inflation, unemployment rate, interest rates, and exchange rates, which collectively influence economic growth, stability, and employment.

How are economic indicators used to forecast economic trends?

Economic indicators, such as consumer confidence indices, manufacturing data, and employment figures, provide insights into future economic performance by reflecting current economic conditions and trends.

What is the role of fiscal policy in managing macroeconomic variables?

Fiscal policy involves government spending and taxation, which can be used to influence economic activity, stabilize output, and promote economic growth.