Assume that you contribute 0 per month – Embark on a transformative financial journey as we delve into the profound impact of contributing $330 per month. Discover the art of budgeting, investing, and saving, empowering you to unlock long-term financial goals and secure a prosperous future.

Through meticulous planning and informed decision-making, you will learn how to harness the power of compound interest, optimize your investments, and navigate debt management strategies. Prepare to witness the extraordinary outcomes that can be achieved through consistent financial contributions.

Monthly Contribution Overview

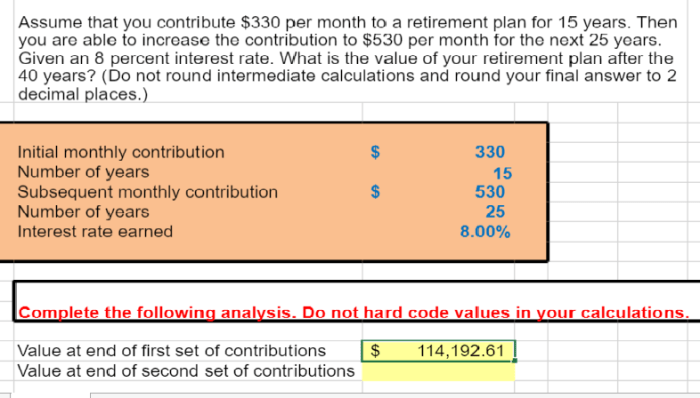

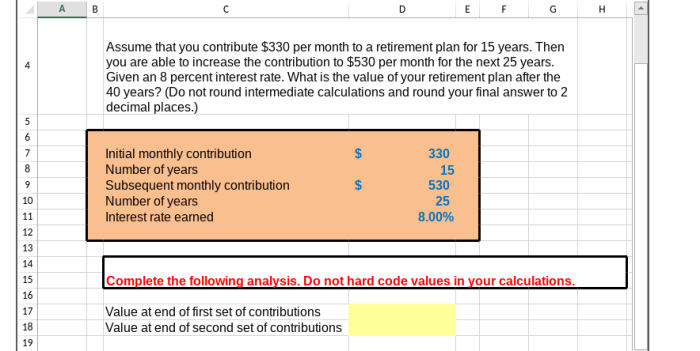

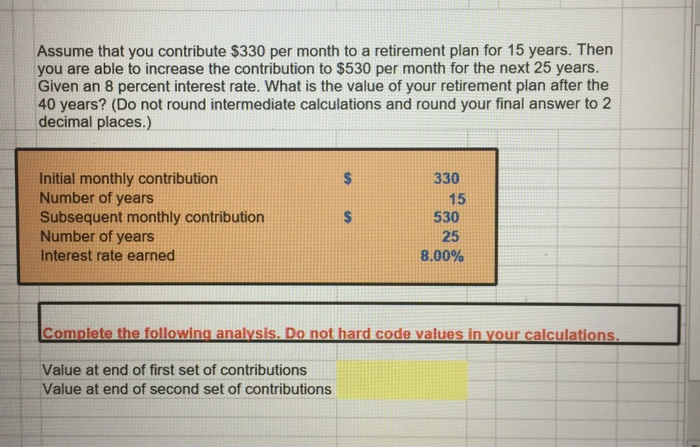

Making a monthly contribution of $330 holds significant financial implications. It can serve as a foundation for achieving various financial goals, such as building an emergency fund, saving for retirement, or investing for long-term wealth accumulation. Consistent contributions over time can have a substantial impact on financial stability and future prosperity.

Budgeting and Financial Planning

To incorporate a $330 monthly contribution into a budget, it is crucial to optimize financial planning. Allocate expenses wisely, prioritizing essential needs while exploring opportunities to reduce non-essential spending. Consider using budgeting tools or apps to track expenses and identify areas for savings.

Balancing expenses, savings, and investments while maintaining the contribution requires a disciplined approach and careful planning.

Investment Options

Regular contributions of $330 offer a range of investment options. Diversify your portfolio by allocating funds across asset classes such as stocks, bonds, and mutual funds. Stocks provide growth potential, while bonds offer stability and income. Mutual funds provide a convenient and diversified way to invest in a basket of securities.

Consider your risk tolerance and investment goals when selecting specific investment vehicles.

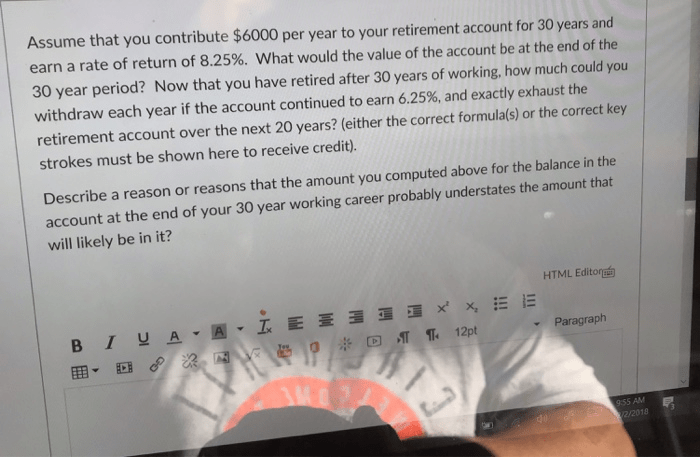

Retirement Planning

Retirement planning is essential, and regular contributions play a vital role. Utilize tax-advantaged retirement accounts like 401(k)s and IRAs to maximize savings and reduce tax liability. Calculate your retirement savings goals and adjust contributions accordingly. Early and consistent contributions can significantly enhance your retirement prospects, ensuring financial security in your later years.

Savings Strategies

Complement monthly contributions with effective savings strategies. High-yield savings accounts offer higher interest rates, maximizing your returns. Establish an emergency fund for unexpected expenses, ensuring financial resilience. Utilize automated savings plans to effortlessly transfer funds to savings accounts, fostering a disciplined savings habit.

Explore additional income streams or consider reducing expenses to further enhance your savings capacity.

Debt Management

Managing debt while maintaining monthly contributions requires strategic planning. Prioritize high-interest debt and consider debt consolidation or refinancing options to reduce interest payments. Create a debt payoff plan that aligns with your financial situation and stick to it diligently. Negotiate with creditors if necessary to secure favorable repayment terms.

Balancing debt management and regular contributions requires careful planning and financial discipline.

Tax Implications

Regular $330 contributions have tax implications. Explore potential tax deductions or credits associated with these contributions to minimize your tax liability. Utilize tax-efficient investment strategies to maximize your after-tax returns. Consult with a tax professional for personalized guidance to ensure optimal tax planning.

Long-Term Financial Goals: Assume That You Contribute 0 Per Month

Consistent $330 monthly contributions can pave the way towards achieving long-term financial goals. Compound interest, the snowball effect of earning interest on interest, can significantly enhance your savings over time. Invest for the long term, allowing your money to grow exponentially.

Share success stories or case studies of individuals who achieved financial success through regular contributions, demonstrating the transformative power of consistent saving and investing.

FAQ Resource

How can I incorporate $330 monthly contributions into my budget?

Review your expenses and identify areas where you can reduce spending. Allocate a specific portion of your income towards your $330 contribution and stick to it.

What investment options are suitable for regular $330 contributions?

Consider a diversified portfolio that includes stocks, bonds, and mutual funds. Research different investment vehicles and consult with a financial advisor to determine the best options for your risk tolerance and financial goals.

How can I maximize my savings while making monthly contributions?

Utilize high-yield savings accounts, set up automated savings plans, and explore strategies to increase your income. Regularly review your expenses and identify opportunities to reduce unnecessary spending.